Accounting and bookkeeping are the cornerstones of any successful business, providing the foundation for financial stability and informed decision-making. In the dynamic and rapidly evolving economy of the United Arab Emirates (UAE), these services are not just a regulatory requirement but a strategic necessity. JYWA SETTLERS, a leading financial consultancy firm, offers unparalleled accounting and bookkeeping services, ensuring businesses achieve their long-term goals with precision and compliance.

The Importance of Accounting and Bookkeeping

Accounting and bookkeeping are essential for maintaining accurate financial records, tracking expenses, and ensuring compliance with tax laws. These practices provide a clear picture of a company’s fiscal health, which is critical for strategic planning and operational efficiency. In today’s globalized economy, accounting and bookkeeping have become increasingly streamlined and technical, largely due to the implementation of International Financial Reporting Standards (IFRS). These standards ensure consistency, transparency, and comparability of financial statements across international borders, making accounting more complex yet more standardized.

The Role of Accounting and Bookkeeping in Business Success

In the UAE, accurate accounting and bookkeeping are mandated by law, but their benefits extend far beyond mere compliance. These services help businesses avoid errors, fraud, and regulatory penalties, while also providing a robust framework for financial analysis and decision-making. By outsourcing these functions to a professional chartered accountant firm like JYWA SETTLERS, businesses can save costs and gain access to comprehensive and tailored financial solutions.

JYWA SETTLERS: Your Partner in Financial Success

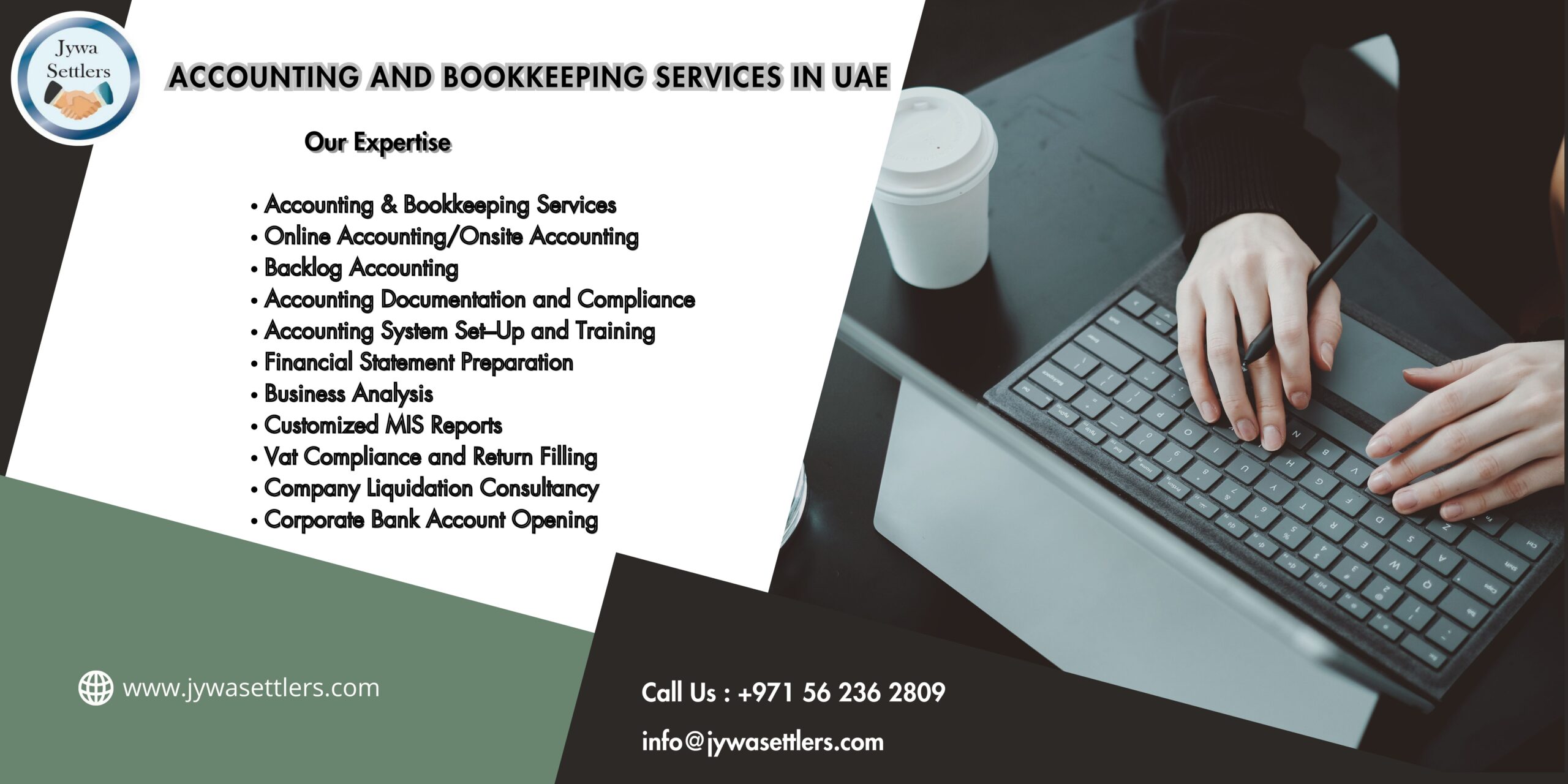

JYWA SETTLERS offers a full spectrum of accounting and bookkeeping services designed to meet the unique needs of businesses in the UAE. Our dedicated team of professional accountants ensures that your financial records are in compliance with IFRS and all legal requirements. Here’s a closer look at the services we provide:

1. Accounting & Bookkeeping Services

Our core services include maintaining accurate and up-to-date financial records, tracking expenses, and ensuring compliance with all relevant regulations. We offer both online and onsite accounting services, giving you the flexibility to choose the model that best suits your business needs.

2. Online Accounting/Onsite Accounting

We provide both online and onsite accounting services, allowing you to choose the most convenient option for your business. Online accounting offers the flexibility to access your financial records from anywhere, while onsite accounting ensures hands-on support from our team.

3. Backlog Accounting

If your business has fallen behind in its accounting, we offer backlog accounting services to bring your records up to date. This service is crucial for businesses that need to meet regulatory requirements or prepare for audits.

4. Accounting Documentation and Compliance

We ensure that all your accounting documentation is accurate and compliant with UAE regulations. This includes maintaining records of transactions, preparing financial statements, and ensuring that all documents meet regulatory standards.

5. Accounting System Set-Up and Training

We assist businesses in setting up their accounting systems and provide training to ensure that your team can effectively manage financial records. Our experts will help you choose the right software and set up processes that streamline your accounting operations.

6. Financial Statement Preparation

We prepare comprehensive financial statements, including balance sheets, income statements, and cash flow statements. These documents provide a clear picture of your business’s financial health and are essential for informed decision-making.

7. Business Analysis

Our business analysis services provide insights into your financial performance, helping you identify strengths, weaknesses, and opportunities for improvement. We use advanced analytical tools to give you a detailed understanding of your financial position.

8. Customized MIS Reports

We offer customized Management Information System (MIS) reports that provide detailed insights into your business’s financial performance. These reports are tailored to meet your specific needs and help you make informed decisions.

9. VAT Compliance and Return Filing

VAT compliance is critical for businesses in the UAE. We ensure that your business meets all VAT requirements and assist with return filing, helping you avoid penalties and stay compliant with tax laws.

10. Company Liquidation Consultancy

If your business is facing liquidation, we provide expert consultancy services to guide you through the process. Our team will help you manage the financial and legal aspects of liquidation, ensuring a smooth and compliant transition.

11. Corporate Bank Account Opening

We assist businesses in opening corporate bank accounts, which is essential for managing financial transactions. Our team will guide you through the documentation and regulatory requirements, ensuring a seamless process.

The Impact of IFRS on Accounting and Bookkeeping

The adoption of International Financial Reporting Standards (IFRS) has had a profound impact on accounting and bookkeeping practices globally, including in the UAE. IFRS provides a standardized framework for financial reporting, ensuring consistency and transparency across international borders. This has made accounting more technical and complex, but also more reliable and comparable.

For businesses in the UAE, compliance with IFRS is essential for maintaining credibility and trust with stakeholders, including investors, creditors, and regulatory authorities. JYWA SETTLERS ensures that your financial records are in full compliance with IFRS, providing you with accurate and transparent financial statements that meet international standards.

The Benefits of Outsourcing Accounting and Bookkeeping Services in UAE

Outsourcing your accounting and bookkeeping services to a professional firm like JYWA SETTLERS offers numerous benefits:

1. Cost Savings

Outsourcing can significantly reduce the costs associated with maintaining an in-house accounting department. You can save on salaries, benefits, and training expenses, while also gaining access to expert services at a fraction of the cost.

2. Expertise and Experience

Professional accounting firms have extensive experience and expertise in managing financial records, ensuring compliance, and providing strategic financial advice. By outsourcing, you gain access to a team of experts who can help you navigate complex financial regulations and make informed decisions.

3. Focus on Core Business Activities

Outsourcing your accounting and bookkeeping allows you to focus on your core business activities, such as sales, marketing, and customer service. This can help you grow your business and achieve your long-term goals.

4. Scalability

Outsourcing provides the flexibility to scale your accounting services up or down based on your business needs. This is particularly beneficial for growing businesses that need to adjust their accounting resources as they expand.

5. Compliance and Accuracy

Professional accounting firms ensure that your financial records are accurate and compliant with all relevant regulations. This reduces the risk of errors, fraud, and regulatory penalties, providing peace of mind and financial security.

The Role of Technology in Modern Accounting

Technology has revolutionized accounting and bookkeeping, making these processes more efficient, accurate, and accessible. JYWA SETTLERS leverages the latest accounting software and tools to provide cutting-edge services to our clients. Here’s how technology is transforming accounting:

1. Cloud Accounting

Cloud accounting allows businesses to access their financial records from anywhere, at any time. This provides greater flexibility and convenience, enabling real-time collaboration and decision-making.

2. Automation

Automation tools streamline repetitive tasks, such as data entry and reconciliation, reducing the risk of errors and freeing up time for strategic activities. This enhances the efficiency and accuracy of accounting processes.

3. Data Analytics

Advanced data analytics tools provide deep insights into financial performance, helping businesses identify trends, opportunities, and areas for improvement. These insights are critical for making informed decisions and driving business growth.

4. Security

Modern accounting software offers robust security features to protect sensitive financial data. This includes encryption, multi-factor authentication, and regular backups, ensuring that your financial information is secure and protected.

In the competitive and dynamic economy of the UAE, accurate accounting and bookkeeping are essential for business success. JYWA SETTLERS offers a comprehensive range of services designed to meet the unique needs of businesses, ensuring compliance, accuracy, and strategic insight. By leveraging the latest technology and adhering to international standards, we provide our clients with the tools and expertise they need to achieve their long-term goals.

Whether you need help with financial statement preparation, VAT compliance, or corporate bank account opening, JYWA SETTLERS is your trusted partner in financial success. Let us handle your accounting and bookkeeping needs, so you can focus on growing your business and achieving your vision. Contact us today to learn more about how we can help you succeed.