In the landscape of modern global business, adherence to stringent financial regulations is paramount for sustainable growth and long-term success. As a leading Financial Consultancy firm, JYWA SETTLERS has taken the mantle of guiding businesses through the complexities of the United Arab Emirates’ (UAE) comprehensive transfer pricing rules and the intricate corporate tax framework. With a deep understanding of the evolving regulatory landscape, JYWA SETTLERS ensures that businesses can navigate the nuances of the UAE’s financial ecosystem with confidence and integrity.

Transfer pricing rules

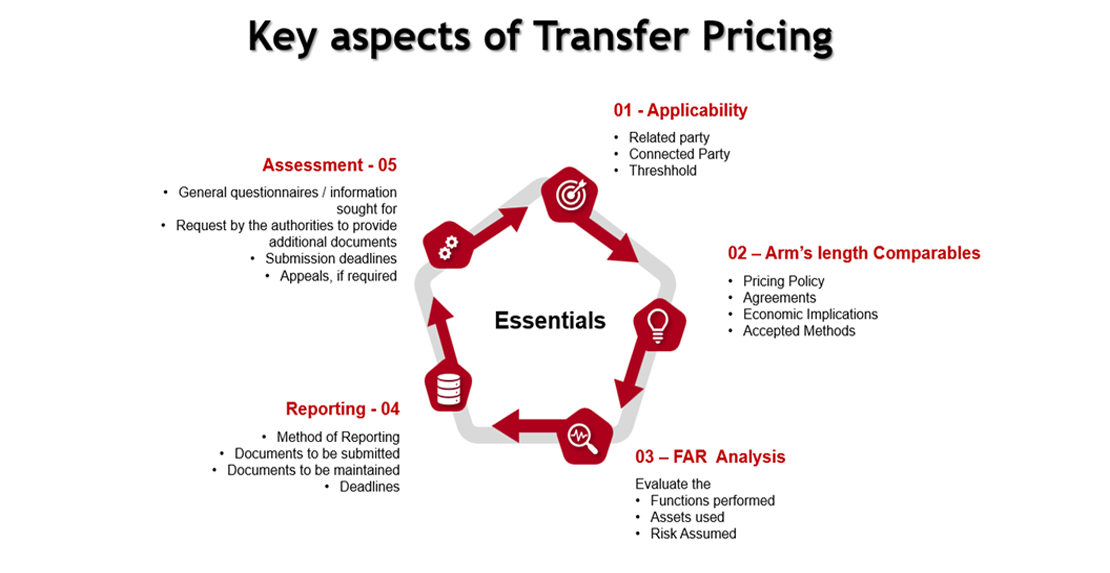

Transfer pricing rules, a critical component of the UAE’s financial regulatory framework, are designed to ensure that fair market values are attributed to transactions between entities within the same enterprise. Notably, these rules extend beyond Multinational Enterprise (MNE) Groups, covering transactions and arrangements with Related Parties or Connected Persons in domestic groups. This broad coverage serves as a safeguard against potential exploitation and unfair financial practices, fostering transparency and equity within the UAE’s business environment.

Coverage under the term ‘Related Party’

The term ‘Related Party’ under the UAE’s transfer pricing rules encompasses entities that share a direct or indirect relationship, such as subsidiaries, joint ventures, or individuals with substantial control or influence over the business. Similarly, the term ‘Connected Persons’ refers to entities that are linked through mutual control, ownership, or economic interests, even if a formal legal relationship does not exist. The inclusion of both Related Parties and Connected Persons highlights the comprehensive nature of the UAE’s regulatory framework, ensuring that all financial dealings within a business network adhere to the highest standards of fairness and transparency.

Deductibility of expenses / payments in relation to ‘Connected Persons’

Deductibility of expenses and payments in relation to Connected Persons is subject to stringent scrutiny under the UAE’s transfer pricing rules. The aim is to prevent the exploitation of financial relationships for undue financial advantage, thereby fostering a level playing field for all entities operating within the UAE’s vibrant economic landscape. By regulating the deductibility of expenses and payments, the UAE reinforces its commitment to maintaining a fair and equitable business environment, where all entities contribute to the nation’s economic progress on an equal footing.

OECD guidance

The Organization for Economic Cooperation and Development (OECD) guidance serves as a vital reference point for the UAE’s transfer pricing regulations, offering a robust framework that aligns with international best practices. By leveraging the OECD’s comprehensive guidance, the UAE strengthens its position as a global financial hub, ensuring that its regulatory standards remain in line with international norms, thereby fostering investor confidence and promoting sustainable economic growth.

Transfer pricing methods

The application of various transfer pricing methods enables businesses to determine fair and equitable prices for transactions within the same enterprise. Notably, the choice of the appropriate transfer pricing method depends on the nature of the transactions, the availability of reliable data, and the specific circumstances of the entities involved. By leveraging a diverse set of transfer pricing methods, businesses can establish fair market values, fostering transparency and credibility within their financial operations.

Self-assessment

The concept of self-assessment places the responsibility on businesses to ensure compliance with the UAE’s transfer pricing rules. By conducting regular internal assessments and audits, businesses can proactively identify and rectify any discrepancies or non-compliance issues, fostering a culture of transparency and accountability within the organization. Self-assessment serves as a vital tool for businesses to stay ahead of regulatory requirements, minimizing the risks associated with potential penalties and legal repercussions.

Preparation of transfer pricing documentation

Preparation of transfer pricing documentation serves as a crucial aspect of compliance management for businesses operating within the UAE. The documentation process entails the meticulous recording and reporting of financial transactions and arrangements, ensuring that businesses can substantiate the arm’s length basis for pricing their dealings with Related Parties and Connected Persons. By maintaining comprehensive transfer pricing documentation, businesses can demonstrate their commitment to transparency and compliance, fostering trust and credibility within the UAE’s financial ecosystem.

The issuance of Ministerial Decision No. (97) Of 2023 on the Requirements for Maintaining Transfer Pricing Documentation by the Ministry of Finance underscores the UAE’s dedication to promoting transparency and fairness within its tax system. This decision emphasizes the significance of standardized transfer pricing documentation, ensuring that taxpayers can substantiate the fairness of their financial transactions with Related Parties and Connected Persons. By adhering to the guidelines outlined in the Ministerial Decision, businesses can streamline their compliance efforts, minimizing the administrative burden associated with regulatory requirements.

Federal Decree Law No. (47) Of 2023 on the Taxation of Corporations and Businesses reinforces the UAE’s commitment to enforcing robust transfer pricing rules and documentation requirements. By mandating adherence to transfer pricing regulations, the decree aims to prevent the influence of relationships on the pricing of transactions within MNE groups, fortifying the integrity of the UAE’s financial landscape. The decree serves as a testament to the UAE’s proactive approach to fostering transparency and equity within its business environment, contributing to the nation’s economic stability and growth.

Master and local file

The transfer pricing documentation requirements, as outlined in the Ministerial Decision, impose specific thresholds for businesses to maintain comprehensive records. Notably, businesses must prepare both a master file and a local file if they meet certain revenue criteria. This standardized approach streamlines the documentation process, enabling businesses to efficiently substantiate the fairness of their financial transactions with Related Parties and Connected Persons, thereby reducing the compliance burden and fostering a culture of transparency and accountability.

Some risk factors for challenge

In addition to the documentation requirements, the Ministerial Decision specifies the transactions and arrangements that must be included in the local file. By providing clarity on the scope of transactions subject to documentation, the decision minimizes ambiguity and ensures that businesses maintain comprehensive records for all relevant financial dealings, thereby fostering transparency and mitigating the risks associated with potential non-compliance.

Businesses operating within the UAE must be mindful of several risk factors that can potentially lead to regulatory challenges. Non-compliance with transfer pricing rules and documentation requirements can result in financial penalties, reputational damage, and legal repercussions, all of which can impede a company’s growth and sustainability within the UAE’s competitive business environment. By proactively identifying and addressing potential risk factors, businesses can strengthen their compliance efforts and establish themselves as stewards of integrity and transparency within the UAE’s financial landscape.

Penalties

The imposition of penalties for non-compliance serves as a significant deterrent for businesses operating within the UAE. Penalties associated with violations of transfer pricing rules and documentation requirements can have far-reaching implications, including financial repercussions and reputational damage. By prioritizing compliance and fostering a culture of transparency and accountability, businesses can mitigate the risks associated with potential penalties, safeguarding their financial standing and credibility within the UAE’s competitive market.

In summary, JYWA SETTLERS remains at the forefront of enabling businesses to navigate the complexities of the UAE’s rigorous transfer pricing rules and corporate tax framework. By emphasizing the significance of compliance, transparency, and accountability, JYWA SETTLERS empowers businesses to establish themselves as beacons of integrity and reliability within the UAE’s vibrant business landscape. Through a strategic and comprehensive approach to compliance management, businesses can not only ensure adherence to regulatory requirements but also foster sustainable growth and contribute to the nation’s economic prosperity.